The Rising Finance Phenomenon Quietly Taking the Industry by Storm

An introduction to the underpaid and overlooked.

In my first year as a married man, I earned just shy of $13,500.

For most of my life, personal finance advice felt like something to aspire to – but in reality, impractical.

I simply didn’t earn enough money.

Foundational goals such as building a 6-month emergency fund or saving 20% for a down deposit felt as achievable as getting drafted for the NFL while shopping at Target.

Like many people on the lower end of the economic spectrum, I also felt shame for my position.

The American Dream of being able to accomplish anything you want quickly turns into the American Guilt when you don't.

My experience is not unique. Personal finance felt like something I wasn’t worthy of, and this feeling is becoming more common.

A series of macroeconomic trends and social pressures are pushing millions of people to rally around a new term that will not only change the landscape of personal finance but transform a web of related industries as a result.

What happens when the singular goal of financial advice becomes survival?

That is what I want to dive into with you as we parse out the opportunities of poverty finance.

Thesis

Therefore, the opportunity to serve the lowest earners with content unique to their situation and desires will grow substantially in the years to come.

What the numbers say about our poverty hypothesis

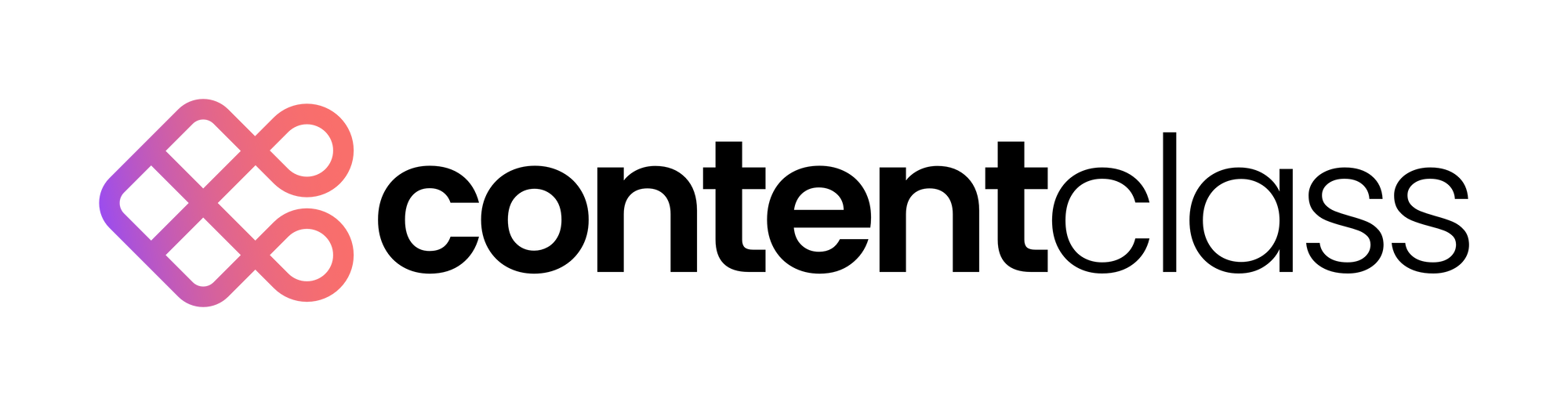

Point #1: Search data confirms an increased interest in defining what is “poor”

I stumbled upon my first hint of a trend while building a content strategy for a career development site. While diving into the keyword and Google Trend data, I found something interesting.

The above chart shows that the number of people searching for "define poor" is currently at an all-time high.

Single data points like this can often be blown out of proportion. With more people coming online every day and platforms like TikTok causing swells in search traffic almost overnight, it's not uncommon to see all-time highs for keywords on a regular basis.

The key is to see if surrounding trends, topics, and keywords are also experiencing the same rise in interest. Of all the charts I looked through, I found the following most compelling.

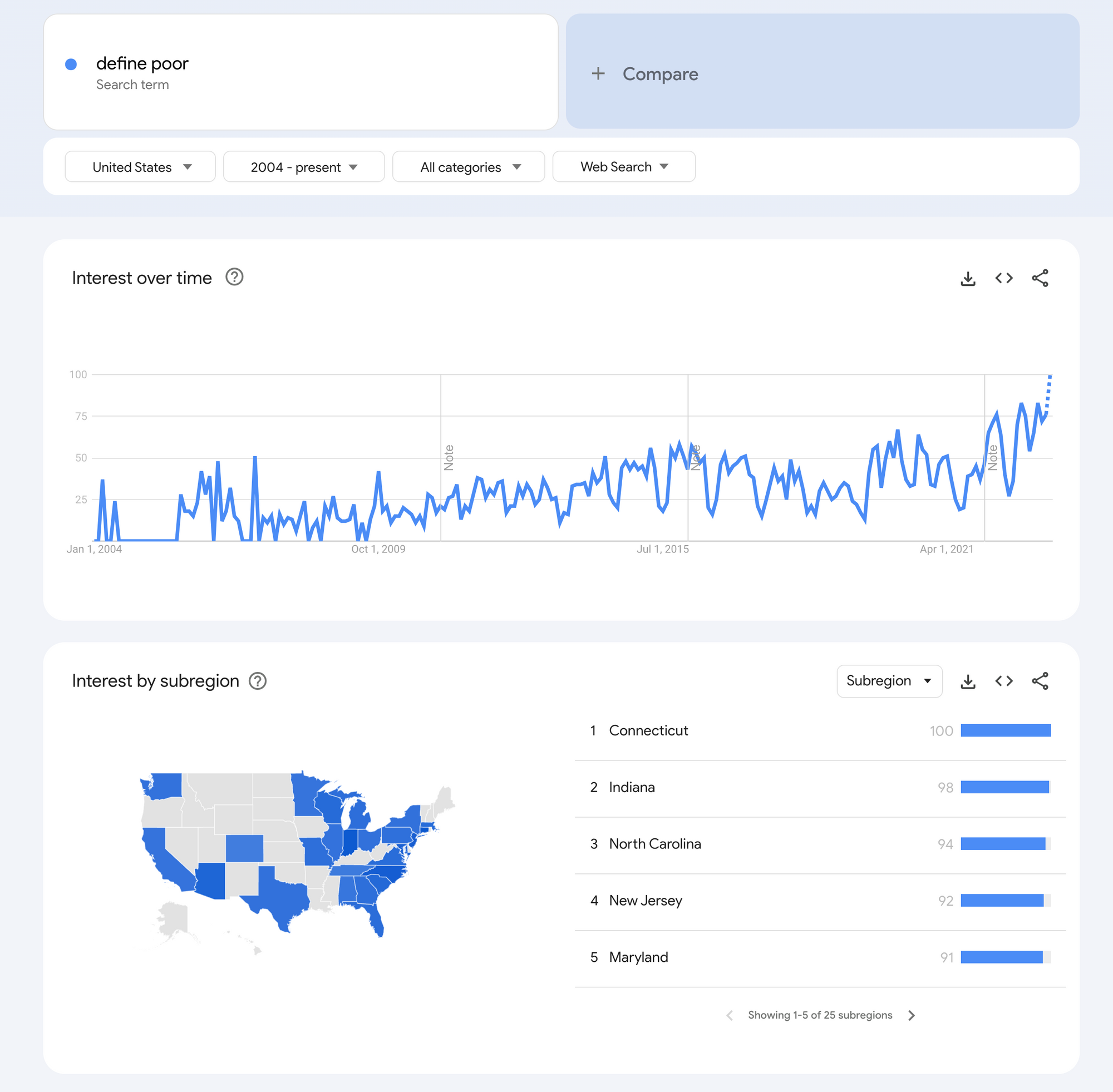

This chart tracks how many searchers ask, "What is the federal poverty level?" In 2012, near the end of the Great Recession, you can see a brief spike followed by a leveling out for the next decade.

But for the last 2+ years, there's been a steady, sustained increase that is not only on par with the 2012 spike but on track to surpass it.

So, the natural follow-up question is, why? Why are people increasingly interested in understanding what level of income constitutes poverty?

Point #2: Demographic data shows a rise in low-income earners

My answer to the “why” question is simple: more people feel poor.

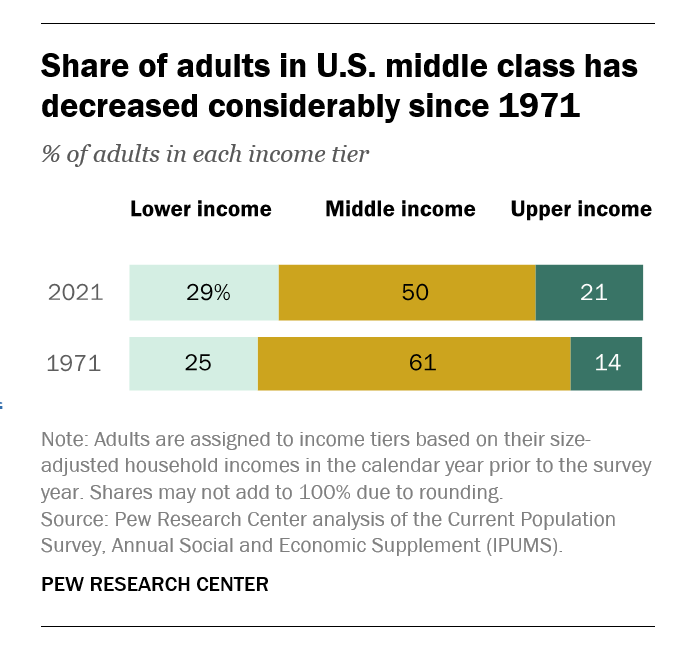

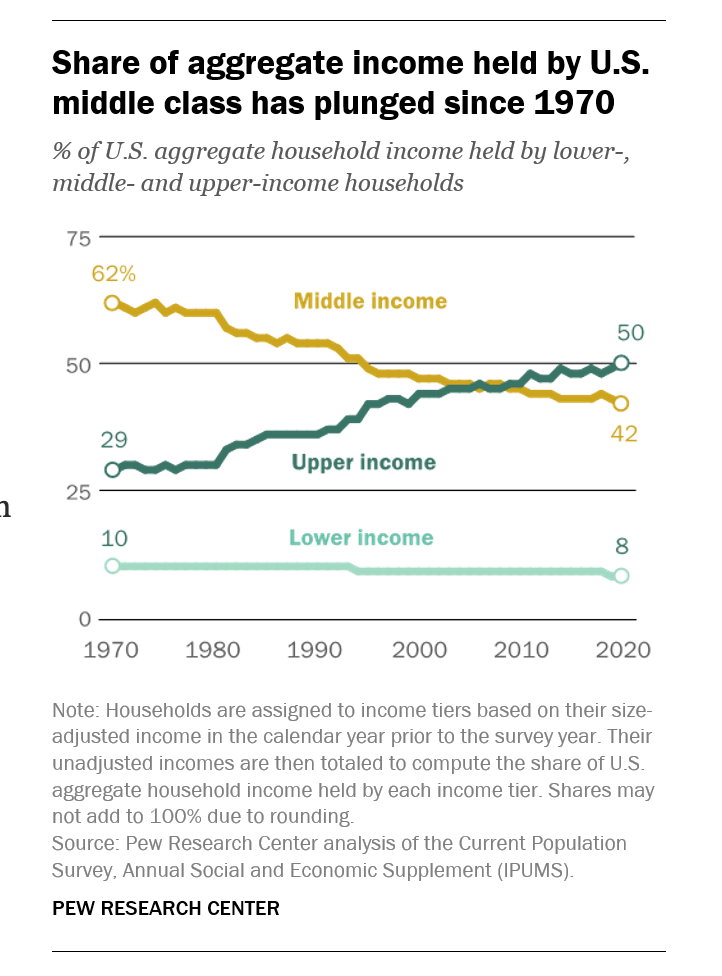

A recent (2022) study by Pew Research dove into the numbers behind the shrinking middle class and revealed some fascinating compliments to our Google Trends data.

First, the middle class is 11% smaller than 50 years ago. But, of course, those people didn't disappear. They were redistributed: 7% into the upper class and 4% into the lower.

Wait a minute. Shouldn't my whole argument be about the rich since they seem to be growing the fastest of any group?

Not exactly.

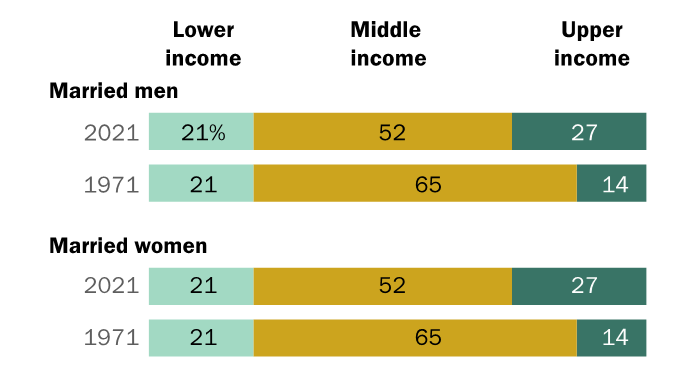

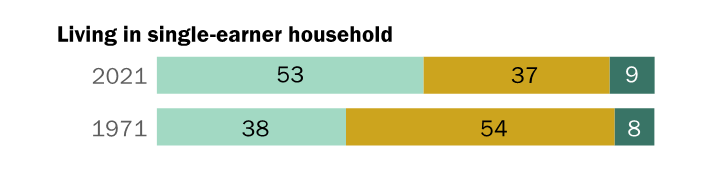

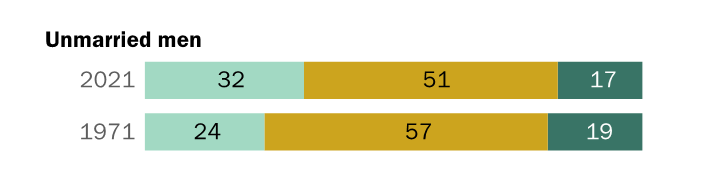

The data collected is in the form of household income. And whereas married couples and multi-earner households have done well…

Almost every group of people/households with only a single income has done worse.

Furthermore, poverty (just like wealth) is relative. This is an idea I'll come back to throughout this report because it's a core part of how creators can reach this target population. Being poor and feeling poor are not the same thing. And small changes to a small amount of income can be drastically worse than big changes to big income.

In the above chart, we can see that the average low-income earner lost 2% of their earning power over the last 50 years. When you’re already going into debt to buy groceries, even a fraction of a percentage can be felt, especially when inflation stretches that gap even further.

But the middle class losing 20% is the real reason I think the search data is what it is. Regardless of how poor the “average” person may truly be, the fact is they feel much more financially constrained than ever before.

And these feelings are heavily skewed towards the younger populations (e.g., people are making less money for longer periods of time, which has a compounding effect on their financial health).

Point #3: Social data highlights the demand for solutions

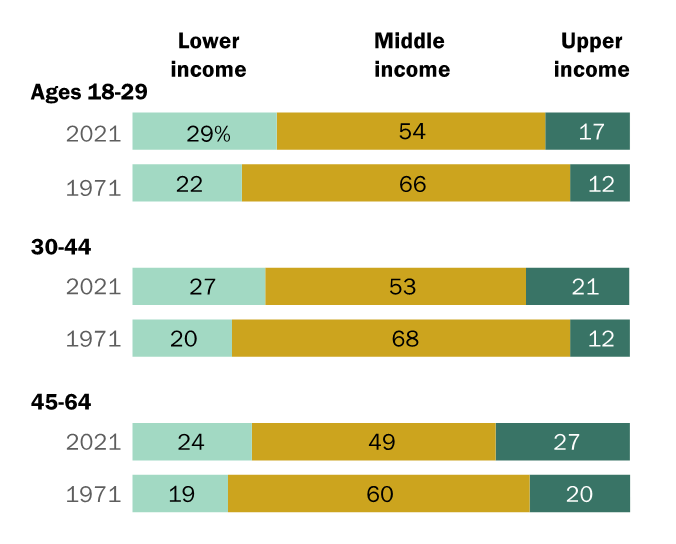

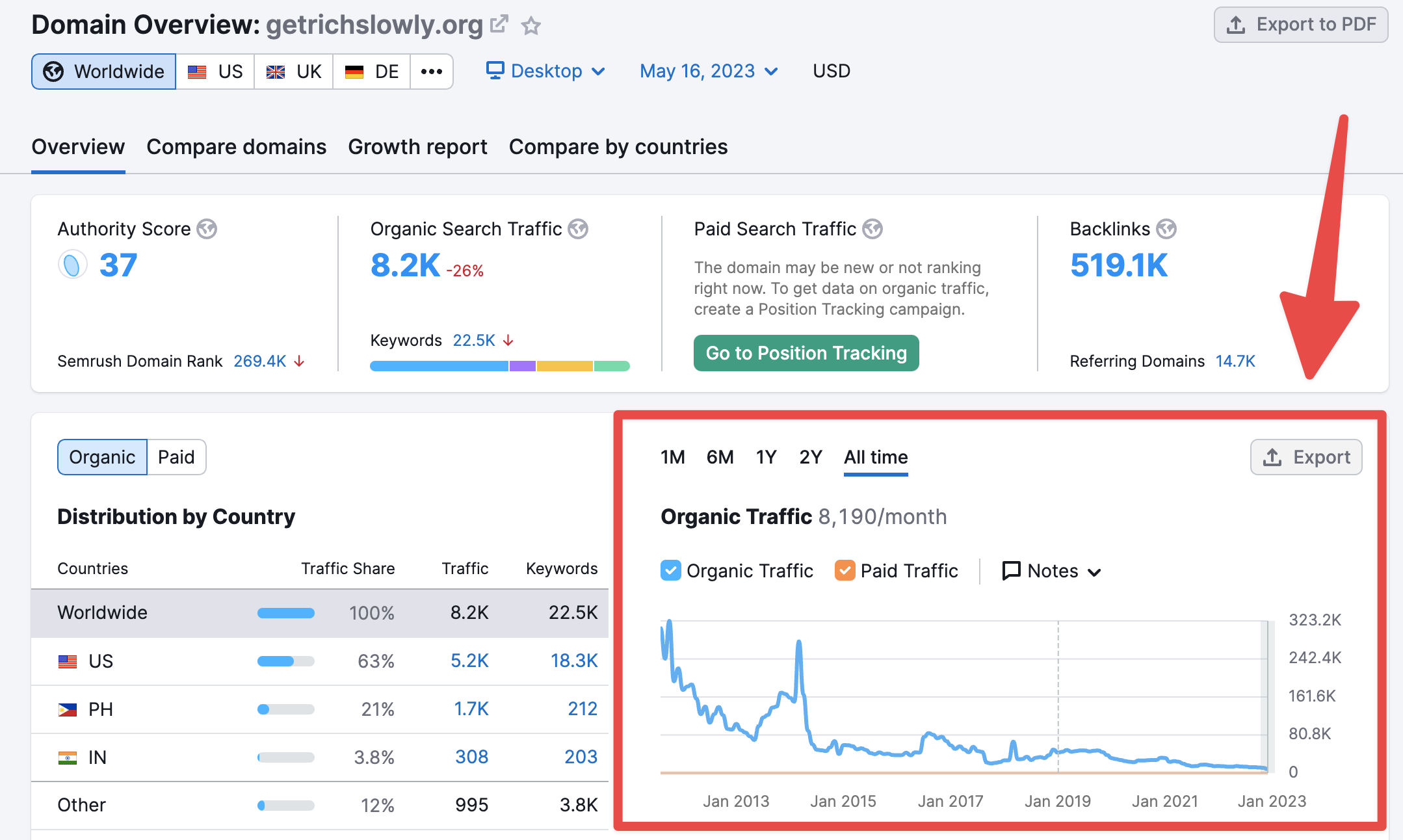

Almost everything we’ve talked about so far can be summarized by the following chart: the growth of the subreddit r/povertyfinance.

Founded in 2018 as a resource for frugality, the group saw a major shift in both the topics addressed and the growth rate near the middle of 2020 (peak pandemic). Since then, the group's content has centered around "struggle" and continued to add approximately 500,000 new members per year.

We will spend much more time dissecting this subreddit, but let's quickly summarize what we've found so far.

- People want to know if they are poor because they increasingly feel financially stretched.

- People, especially younger ones, are earning less money than they’d expect for long periods of their working life.

- These groups are increasingly searching for help, advice, and community online.

How this subreddit tells us what to look for

Whispers of hope; shouts for change. That's what you'll find in one of the fastest-growing communities on Reddit.

As we move towards a clearer idea of what to build, publish, and create for this space, we first need to understand the audience a bit better.

We know they feel an external, economic press. But what kinds of conversations does that actually lead to? What concerns are top of mind? Which pains are they trying to solve first? And what topics are strictly off-limits?

To answer these questions, let's pull some critical insights from the subreddit.

Who they are in their own words:

“Financial advice, frugality tips, stories, opportunities, and general guidance for people who are struggling financially. No Judgement, just advice!

Much of the financial advice online and on reddit is aimed at people who have varying degrees of disposable income, ability to invest, lots of free time, available transportation, no kids, a partner, access to credit, and beyond.

This is a place for people who do not have a lot, nor ideal circumstances, to help each other get by and hopefully move up in the world.”

From this introduction, we can pull out a few pain points:

- They don’t want to be judged for having less (which traditional finance often does).

- They don’t have financial wiggle room (no investments, savings).

- They’re pressed for time (stretched thin, tired, getting additional jobs/working more hours may not be possible).

- Their mobility is limited (rely on walking and public transportation).

- They’re financially responsible for other humans who cannot work (children, ill parents, siblings, partners).

- They have limited financial tools and knowledge (credit, loans, software, bank accounts).

Themes from the top 10 posts of all time

On Reddit, you can easily sort any subreddit by the most popular posts of varying time periods – one of which is “all time” (since the community was founded). When we do that, we find the following Top 10 posts (summarized for clarity).

- Celebrating getting 1st apartment as an older adult Link

- Why being poor is expensive Link

- Celebrating a handmade item (because they couldn’t afford a gift) Link

- Buying a car for $800 Link

- Rant about overdraft fees Link

- Relationship between mental health and financial stress Link

- Rant about inflation Link

- Celebrating paid-off house Link

- 1st apartment after homelessness Link

- Cheap food hacks Link

Now, here are a couple themes we can pull from the above list:

- Celebrating “small” wins (1, 3, 4, 8, 9) is acceptable. The post about the house was the most controversial one by far — the general consensus was that the community did not want to see stuff like this because it was so far outside their reach.

- Sympathy for situation (2, 5, 6, 7). They want a place to complain where others can acknowledge the difficulty without shaming them or immediately jumping to solutions.

- Practical survival tips (10). The post specifically cited how shops will help you bypass SNAP (Supplemental Nutrition Assistance Program) restrictions to offer cooked meals.

After combing through the top 100 posts, the themes of “food hacks” and “venting/sympathy” continued to be the most prevalent types of content. From there, ways to make small sums of cash very quickly and career advice were the next two subject areas that stood out.

By "small sums," less than $100 seems to be a ballpark figure, and "very quickly" means by the end of the day or within a few hours. The career advice focuses on helping people know what jobs to stay away from, where to find jobs that hire quickly, and identify jobs with unforeseen benefits/perks for those in need.

Richsplaining – When a person who has never experienced poverty gives you patronizing advice on how to get out of poverty.

Plassing – The act of getting compensated for donating plasma.

Anytime you find or contribute unique language to a niche, you reinforce its identity and your belonging.

Related subreddits that share their concerns

Related subreddits are one of my favorite hacks for quickly finding overlapping audiences and topics.

r/povertyfinance lists a few recommended ones I found unique and useful, including:

- /eatcheapandhealthy (5.8 million members) – Eating on a strict budget, but also with limited access to kitchen equipment (e.g., no oven or stove is a recurring theme).

- /beermoney (1.1 million) — Think online entrepreneur content but aimed at making/winning a few dollars.

- /plassing (4,000) — As mentioned above, tips for getting paid for donating plasma.

After using some additional tools, I found a few more overlapping communities worth noting:

- /simpleliving (1.3 million) – Often about minimalism out of necessity.

- /budgetfood (1.2 million) – Useful because they include prices (e.g., $2 burritos, $3 lunches).

- /frugal (3 million) – Practical community to help one find deals, make materials/food last longer, and DIY tips.

Interestingly, almost every theme we pulled from the top 10 posts is represented by another subreddit (small wins, food hacks, quick cash), except for the sympathy/venting theme. Empathy is hard to come by. This is why it's hard to overstate how powerful the bond is when people feel truly seen and understood by another person online.

If we circle back to the questions at the beginning of this section, we can now answer them.

- What kinds of conversations are happening around poverty finance? People are looking for support, understanding, practical survival advice, and actionable ways to improve their situation.

- What concerns or pains are most important to them? Food is the loudest one by far. They’re trying to eat on a budget with limited time and resources. I was surprised that housing and fitness were not more represented, but these threads may be worth pulling on more.

- What topics are off-limits? Anything that makes them feel less or shame-filled. Celebrating financial milestones that are out of their reach or offering discompassionate or tone-deaf advice are certainly on that list.

You can take almost any traditional financial advice, drastically shorten the timeframe for its application, and you'll be on track to creating unique value for the poverty finance niche.

What are the top financial blogs (not) talking about

Up to this point, we've been measuring the opportunity of poverty finance from the outside in. But to get a better picture of what was actually happening in the personal finance blogosphere and creator space, I had to look behind the curtain.

So, I powered up a few SEO tools and started investigating the sites that helped me improve my financial situation. What I found was shocking.

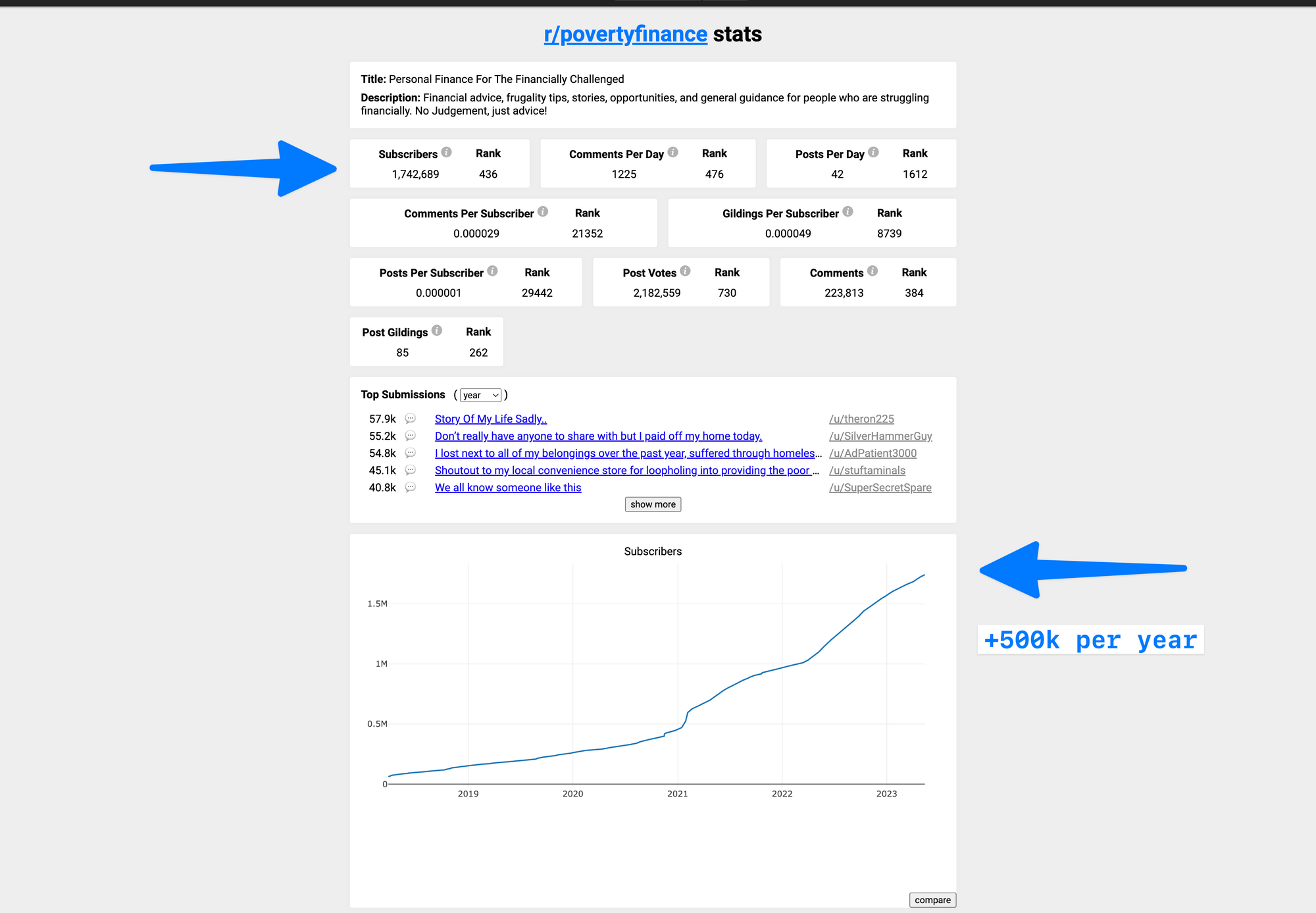

First, I looked at a blog titled Get Rich Slowly. This used to be a heavy hitter in the space, but it had been a while since I read their content – so I expected some drop-off.

As you can see, there was a fair bit more than some. To date, the site has lost 98% of its traffic compared to its all-time high 9 years ago. Upon further research, I saw that the owner had retired from maintaining the site.

Okay, I thought. Now this makes more sense.

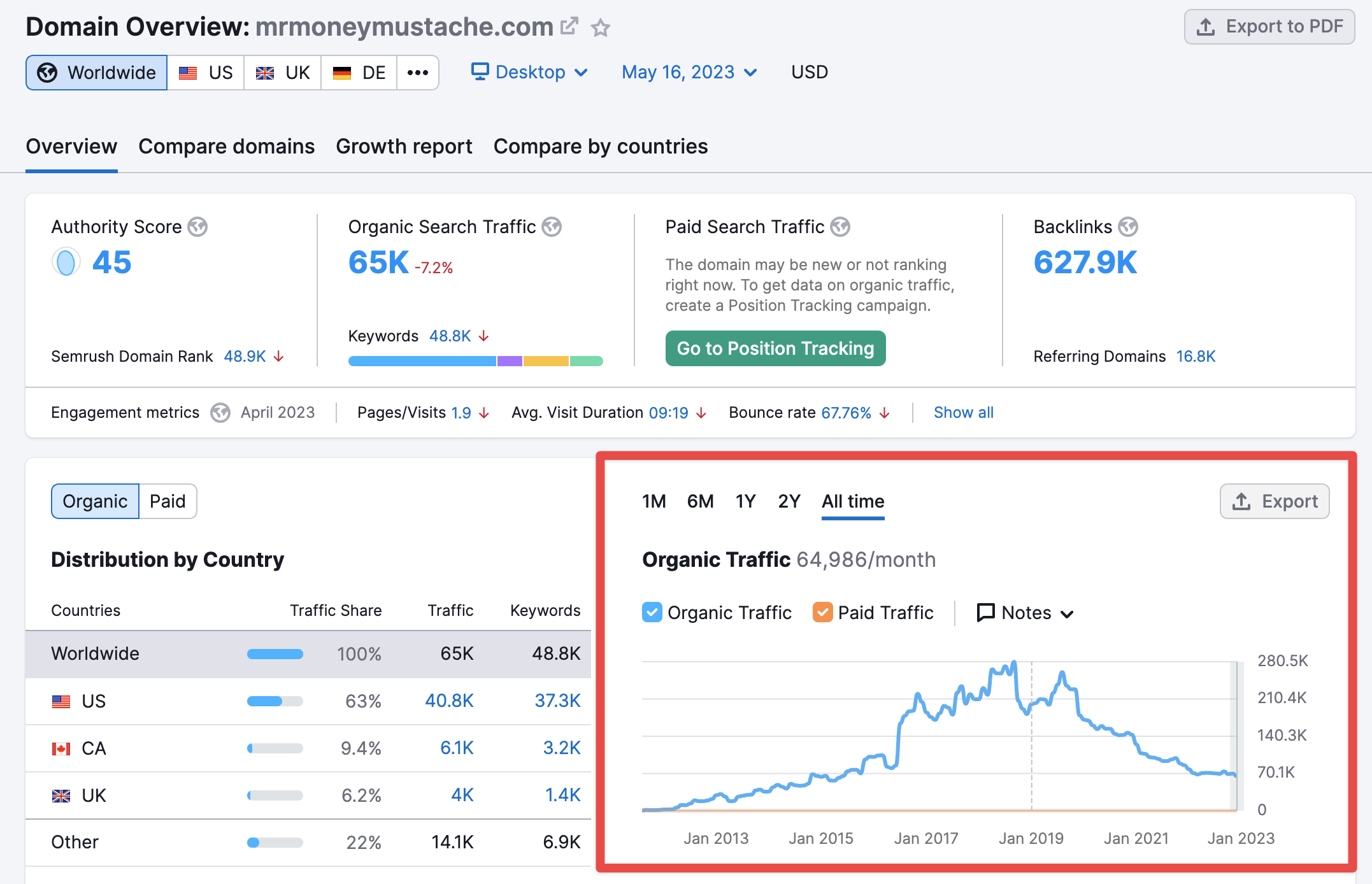

Until I moved on to the next one: Mr. Money Mustache.

This site has lost 75% of its traffic within the last 2 years AND is still being regularly maintained and updated.

Perhaps the changes I was seeing in and around the demand for lower-income financial advice were happening faster than I thought.

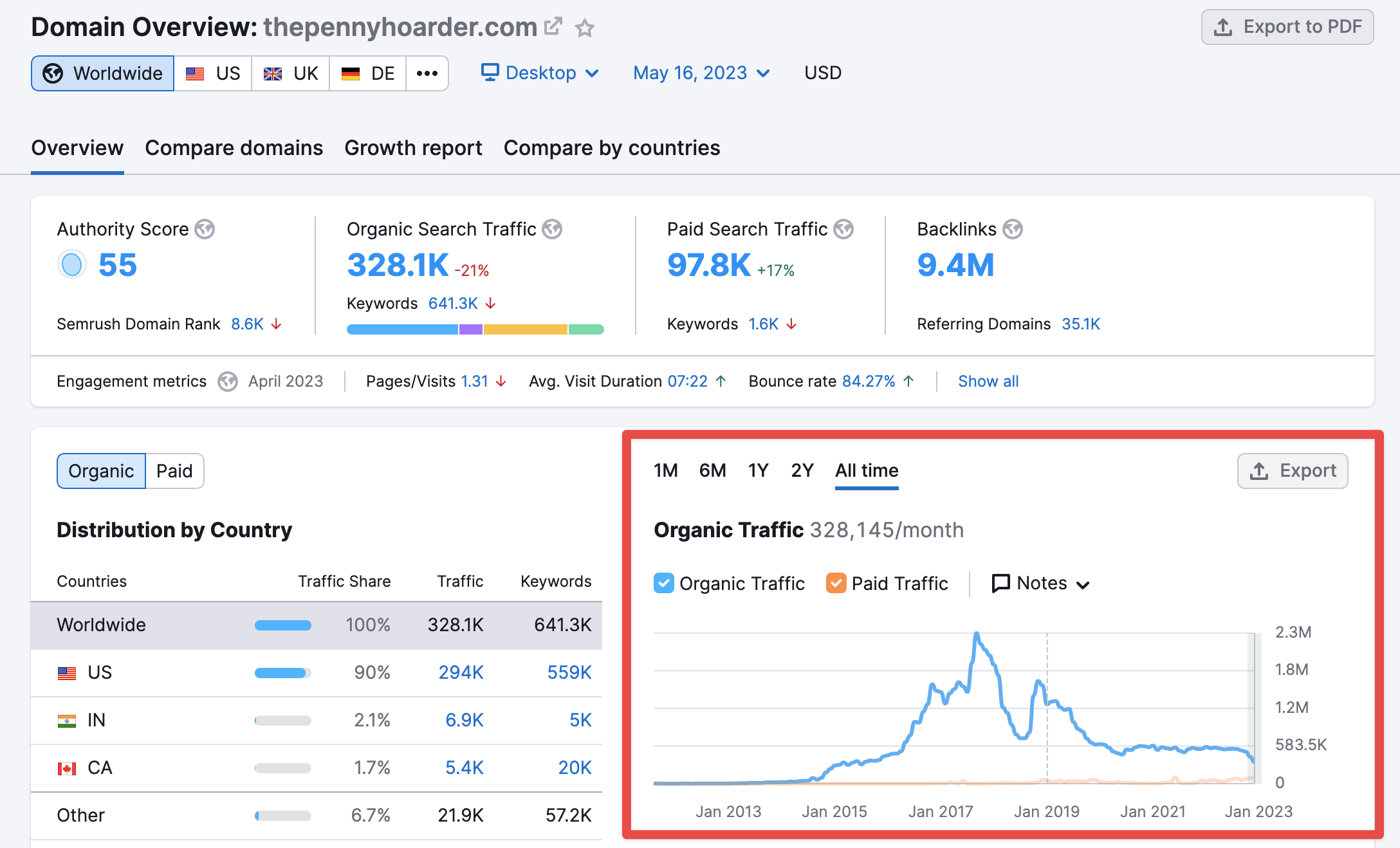

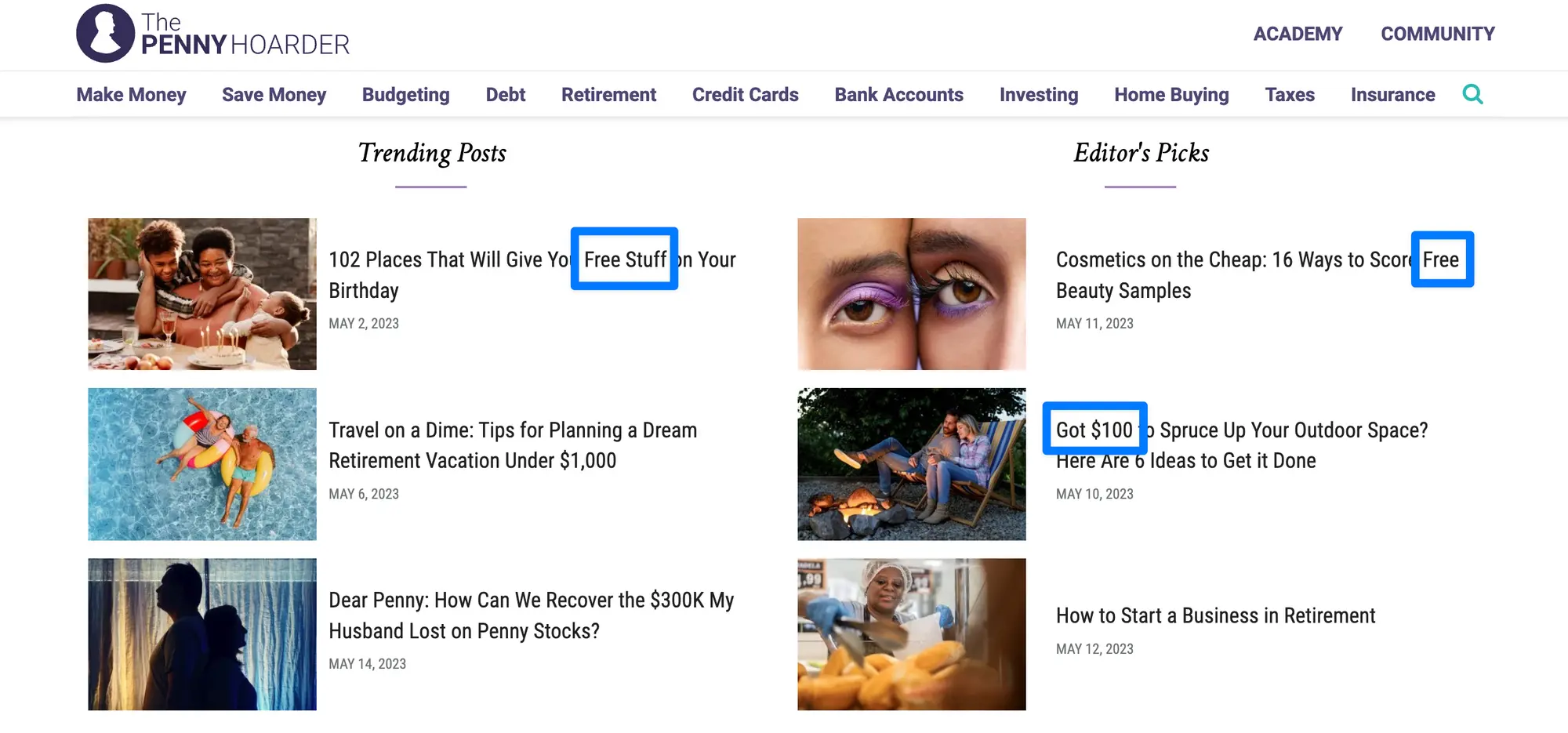

As I continued my research, I ran into the same findings again and again. Here is the The Penny Hoarder’s 83% drop in traffic.

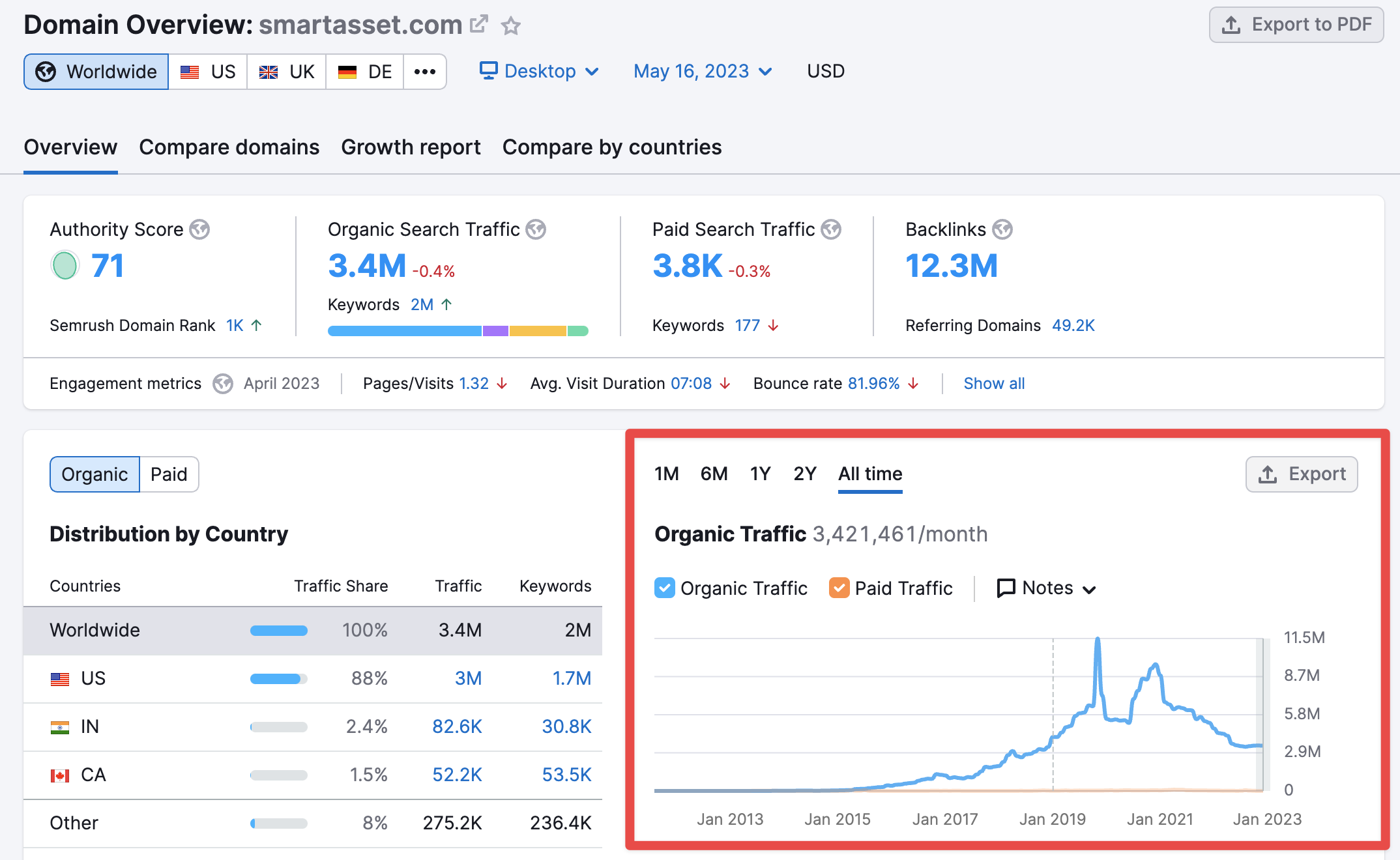

And Smart Asset’s 72% drop.

Clearly, there is a shift happening. But why so quickly and broadly?

The pandemic and the publishing disconnect

My theory stands on two points.

- Covid was an accelerator of trends that were already in motion (e.g., remote work).

- As personal finance publishers experienced more success, they were increasingly disconnected from the shift occurring in their audiences.

I'm not going to elaborate on the covid point because that drum has been beaten quite enough. But here's a resource if you haven't seen the argument before.

As for the disconnect, it’s a problem every public-facing creator faces at some point. Especially if their brand relies on an “everyman” ethic. As they gain more success, and as their access to opportunities and resources grow, the more they will unintentionally alienate their core audience.

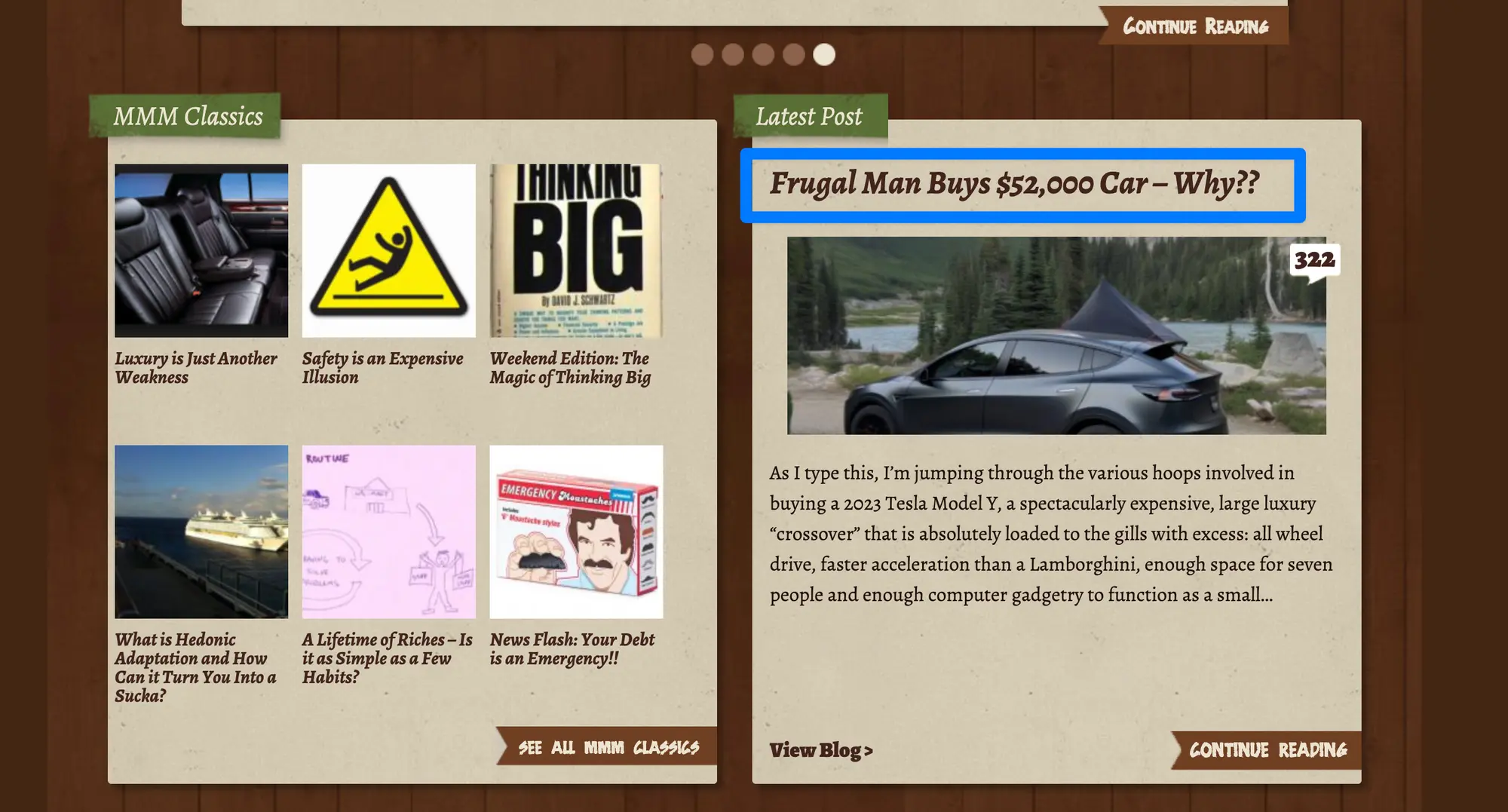

One obvious example is the latest post from Mr. Money Mustache about purchasing a new Tesla.

Even though we're picking on his site in particular, the post merely echoes what I saw across the space: people publishing what is normal to them but increasingly unachievable for the majority.

A glimmer of hope

Now, not everyone is ignorant of the untapped opportunity were addressing (which is why it won't be untapped forever).

A great example was the homepage of The Penny Hoarder, where they highlighted 3 articles that would do well in any of the poverty finance communities we've seen.

- How to get free stuff on your birthday

- How to get free cosmetics

- $100 outdoor projects

Free will always be a popular subject area for almost any demographic, but it carries extra weight within the poverty finance segment because, for many of them, free is a lifeline. It could very well be the difference between eating and not eating on any given day.

The outdoor project tied to a fixed dollar amount was another approach I believe will gain steam. Articles like this can be repurposed with varying amounts ($5, $20, $50) and continue to reach new audiences each time.

All that being said, any of the most popular finance sites could pivot hard into this space and build up a massive library of resources for lower-income individuals. However, I don't think this strategy would work.

Lower-income households are already suspicious of large organizations, which is partly why over 7 million of them don't have a bank account.

Instead, the most influential producer of content in these areas must prioritize trust-building above all else. That will likely mean individuals with relatable circumstances, personalities, and stories will thrive where established institutions will struggle.

So, what could these opportunities look like? And where should you start?

Niche opportunities for poverty finance creators

First, every successful niche always falls within one of the three core markets: health, wealth, and relationships. If a service or product doesn't help you make more money, live better, or feel loved, you'll have a hard time selling it.

We want to keep that filter in mind as we think about the opportunities surrounding poverty finance.

Second, in many ways, what we've talked about could be understood as a "meta trend" — a trend that sits atop other trends and has a broader influence.

Theoretically, you could take the notions of extreme budgeting and survival and apply those constraints to almost any category (which is not a far stretch from my approach).

However, I do think there are specific opportunities worth naming.

Food & Fitness

Food bloggers and YouTubers are consistently the highest-paid class of creators. Furthermore, the ability to niche down within this category is almost unlimited.

A few ideas I believe would do exceptionally well in this space:

- An extreme budget version of the most popular dishes: mac and cheese, cheeseburgers, spaghetti, etc. Titling it along the lines of "$2 Basics" would immediately help the content stand out and gain traction amongst the core audience of lower-income earners.

- Focus on a specific meal types: $1 Desserts, $3 Dinners, etc. This specificity would act as a wedge into the space and enable you to be creative within set constraints.

- Focus on using specific tools: Microwave Masterpieces or Toaster Oven Tastings. Create ALL of your recipes using a single appliance that is accessible to people with small kitchens and limited resources.

Two examples worth mentioning are Struggle Meals and Munchies.

Struggle Meals nails the positioning by targeting the core audience we've addressed (single, low-income, time and resource constrained). However, they misstep a few important details.

First, the kitchen setting is beautiful, which makes it unrelatable. Second, there's no consistent theme to the meals. The host covers the gamut of cuisine options, so the opportunity for creators to steal specific areas is wide open. Third, the host (Frankie Celenza) has a minimal social presence. A creator willing to invest more time building their community will win big.

The second example I want to share is not Munchies as a whole (which is owned by the now-bankrupt Vice), but one of their recurring hosts: Matty Matheson.

In my opinion, Matty is the ideal character for budget-focused food content. He's resourceful, relatable, and irreverent. His cheeseburger video hits a lot of the key points I was looking for when ideating good examples: a simple-to-understand recipe, the setting is a small and messy kitchen, and the narrative is that he's cooking for friends.

Some of the weak points of the content were that Matty uses multiple kitchen items the audience is unlikely to own, and the recipe takes a bit of time to get through.

All of these are levers you can pull to create unique value for an audience:

- Speed

- Cost

- Simplicity

- Setting

- Community

The creator MadFit has seen massive success in the space by adding the following descriptors to her videos: “Apartment & Small Space Friendly (No Equipment, No Jumping).”

I highly recommend you read the comments on her videos if this is an area you’re even slightly interested in.

Money & Finance

This category is the heart of what we've talked about, but it doesn't come without its challenges. The best strategy to start with is to take a contrarian approach to the most prevalent personal finance topics.

Here are a few ideas.

- Don’t save for retirement. How to live a great retirement with $0.

- How to live off credit cards without ruining your life.

- Stop paying off your debt. How to take on the right debt to live better right now

- The anti-establishment toolkit. Where to put your money if you don’t like banks

In each of the examples above, you can see a clear sub-niche that you can dominate: retirement, credit cards, debt, banking. You can apply this idea to any traditional personal finance topic to flip it on its head.

Another approach is to stick with the same tried and true recipes but use smaller dollar amounts.

- How to make $10 a day online

- How to save your first $20

- How to budget $70 a week

By default, these will attract a much different audience than content titled “How I budget my $120k salary.” Remember, one of the currents pushing this trend forward is “survival.”

Most financial advice aims to help people become their best selves and live 1% experiences. But many people aren't in the emotional state to accept those ideas — or tired of the get-rich-quick gurus. So, your job as a creator for these audiences is to help them get to the next day in a practical, achievable way.

Caleb Hammer understands this inside and out, which is why he’s gone from 900 YouTube subscribers to 450,000 in a single year.

His content focuses primarily on debt-ridden millennials with low earning power and poor spending habits. And although his advice tracks with most traditional wisdom (spend less, earn more), the way it’s presented feels refreshingly contextual, even if his presentation is quite mean!

His swelling audience is a testament not only to his ability to reach a target audience, but to the pent-up demand for a different kind of financial advice.

Her model is essentially the envelope system most personal finance people are familiar with. But the difference was the narrative (paying off $70k in debt) and amounts (less than $20 increments) she presented.

She makes financial habits feel achievable, fun, and communal. And her audience has rewarded her with a 7-figure business.

Relationships & Commerce

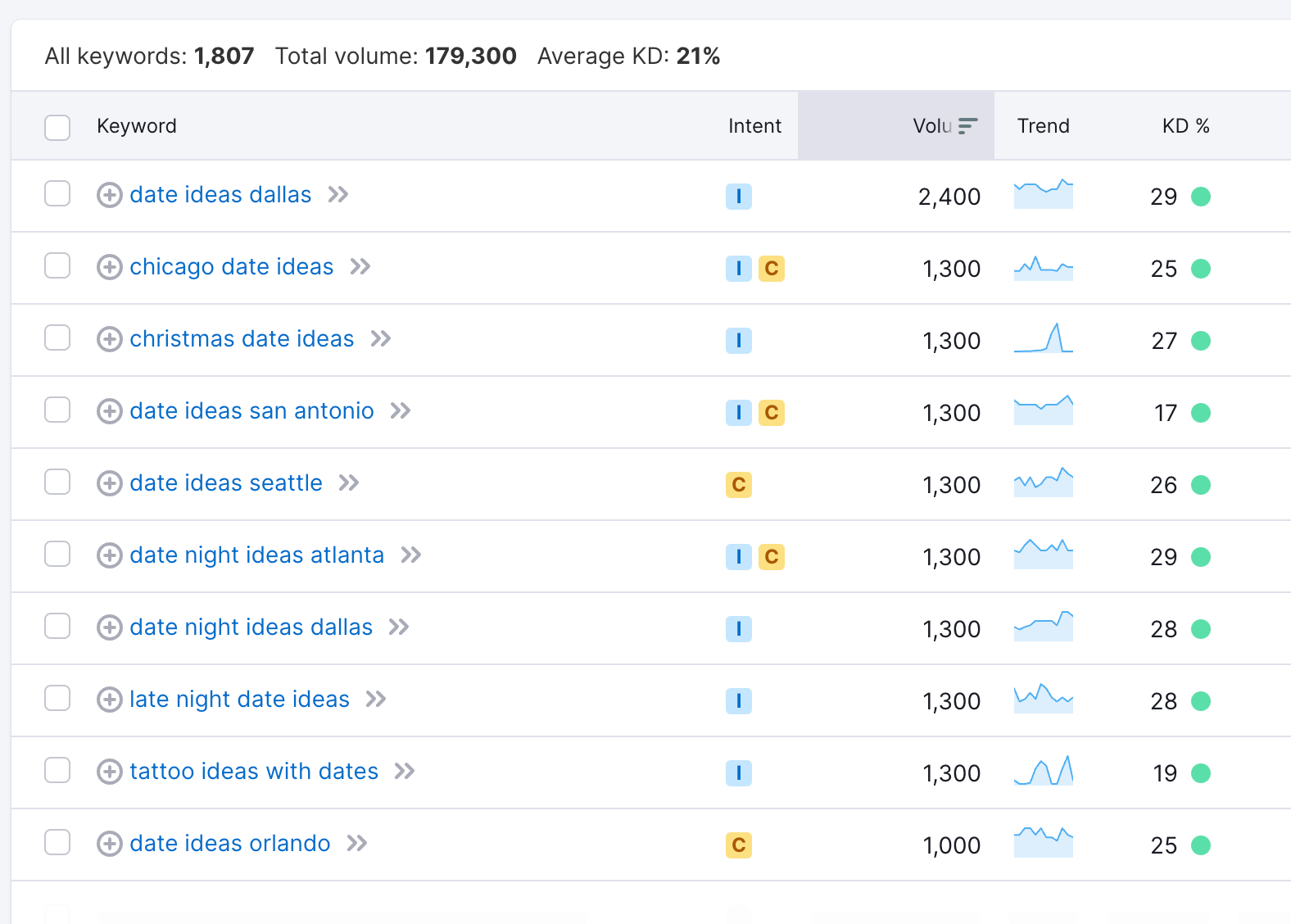

For the final core market, the two opportunities I think are ripe for disruption are dates and gifts.

In terms of search demand, "date ideas" continues to be a blue ocean of underserved searchers. Most of the content ranking (at least for the cities I'm familiar with) is bland, often outdated, and expensive ($100+).

As you can see from the screenshot, the opportunity is primarily location-based. Pick a major city you live in or nearby, curate budget and cheap date ideas, and leverage that into an audience that trusts you with their time and money.

Similarly, gifts are another domain that would benefit from a personality-driven strategy. Most gift lists are published by large affiliate sites. There's an opportunity here to build relationships with Etsy designers, Instagrammers, and other craft-focused outlets to produce low and no-cost gift ideas that anyone can engage with.

Leaning into established fanbases is a smart way to wedge into this market. Such as "3 Lord of the Rings inspired birthday gifts you can make for under $5" or "5 handmade Star Wars anniversary budget gift ideas." That way, you hit a specific event, audience, and price point with each piece of content you publish.

From there, you iterate and double down on what works.

Creators who are tapping on this trend (whether they know it or not)

As we near the end of this report, I want to offer 4 more example creators who are edging their way into this space, all from different angles. I think seeing people like this is great for generating your own ideas about what your creations could look like.

Hoodmeals

This channel is not for the faint of heart if you’re easily grossed out. But for 7 million people, this is their go-to source for a unique combination of humor and meal hacks.

@hoodmeals I done went Mediterranean Meals🌯 #fyp#food ♬ Spongebob Tomfoolery - Dante9k Remix - David Snell

The defining element of the content is limitations. They can often be seen using plastic Tupperware instead of pans or bowls and plastic forks instead of cooking utensils.

Shabaz Says

Famous for their "I'm rich, you're poor" series, the creator flips the script on traditional shame culture. Instead of idealizing the upper class, they mock them in a creative and accessible way, a bit like a Robin Hood of humor.

@shabazsays #duet with @sophiepatersoninteriors love a good antique one does 👏🏽 #povogang #funny #comedy #react #reaction #fyp #foryou #foryoupage #commentary #trending #viral #rich #richlife #money #antique #princess ♬ original sound - sophiepatersoninteriors

This style plays to the empathy line we mentioned in our discussion about the subreddit above. People want to know that their financial difficulties don’t have to make them an "other."

Madison Brooks Travel

Madison specializes in free and near-free travel experiences. Her videos cover everything from moving around Europe for next to nothing to comparing McDonald's meals in different countries.

@madisonbrookstravel psa for aspiring budget travelers!! It is possible to do, and i will teach you how! #budgettravel #traveltipsforbeginners #american #budgettravel #cheaptravel #travelcheap #budgettraveltips ♬ original sound - MADISON BROOKS TRAVEL

What’s unique about this approach is that instead of highlighting the most beautiful vistas, she concentrates most of her content on the financial elements – which has built a deep level of trust with her audience.

Low Income Relief

Nicole is one of the few creators hitting this trend squarely on its head. Her videos address topics such as grants, low-cost medical services, and food stamps. Her government assistance angle allows her to cover a broad range of issues while still targeting a core audience.

Furthermore, her newsjacking strategy provides a near-endless stream of content while giving her viewers a reason to stay subscribed.

Objections

No theory is perfect, but I hope I've proven that (A) there is a shift in demand occurring towards lower-income-focused content and (B) this trend can be seized in several different categories, not just personal finance.

What I still need to address are two of the loudest objections to the thesis.

- The audience quite literally doesn’t have money to spend, so they make a very bad target.

- Isn’t this trend just another form of budgeting content?

To the first point, this is absolutely correct, which is why the opportunity is there.

Companies sell stuff, so they sponsor creators who can help them do that. Creators want to get sponsored, so they create the type of content that will attract companies. It's a cycle that leads to homogenous content and leaves massive segments of the population underserved.

This is where you come in.

The monetization angle starts with ads. They are the easiest and most profitable to implement if an audience isn't ready to pay you. The funnel, then, is to capture people with short-form content and lead them to long-form pieces that have ads (e.g., blog posts and YouTube videos).

From there, I would seek more targeted sponsorships that may pay less than major brands, but could lead to beneficial long-term relationships. My first thoughts are nonprofits, local service providers, career websites, and other creators.

The last would be sponsored giveaways to your audience that also offer you compensation. If you grow a dedicated enough audience, big brands will want to get in front of it. Even if that means giving away their best products and paying you to help.

Eventually, you could also experiment with low-cost merch ideas — especially with practical items (think backpacks, kitchen and household items, printables).

As for the second point, the key difference here is intent.

In SEO, if someone types in “coffee” they could be looking for:

- Information — How do I make coffee

- Navigation – Where can I get coffee

- Transactional – I want to buy a specific type of coffee

- Commercial – I want to see what types of coffee I could buy

In the same way, money content aimed at helping a six-figure earner save for a house is very different than content aimed at helping a person not lose their housing benefits. Traditional budgeting information has always swayed towards helping the middle and upper class achieve their goals. Now is the time for something different.

This is why you can see two creators reach massive levels of success in the same niche for wildly different reasons. Or why a person who seems to be doing everything right never gains any traction.

You have to match your audiences’ desires with your creative intent.

Your intent will determine whether or not your audience accepts you, whether or not your content sticks, and whether or not you stay in the game long enough to win.

Where to go from here

Clarity is the consequence of action.

I wanted to show you the personal finance landscape as I understand it today, but even so, there are many stones I left unturned and entire detours of opportunity I overlooked. The only way to unlock those is to move forward, create content, and pay attention as the path reveals itself to you.

Whether or not you find yourself in any of the niches I touched on, I hope you see what kind of research you can do to better understand who your audience is and where they’re headed next. This whole creator economy phenomenon has only just begun. The reshuffling of what it means to have a career is just getting started.

You’re still early.

For now…